Are you a US resident living abroad? You might be losing money on your tax return without even realizing it! Currency exchange rates can have a surprising impact on...

Don’t Panic! Here’s Your Step-by-Step Guide to Handling IRS Notices and Audits Received an IRS notice or facing an audit? Stay calm and informed. Learn the essential steps to...

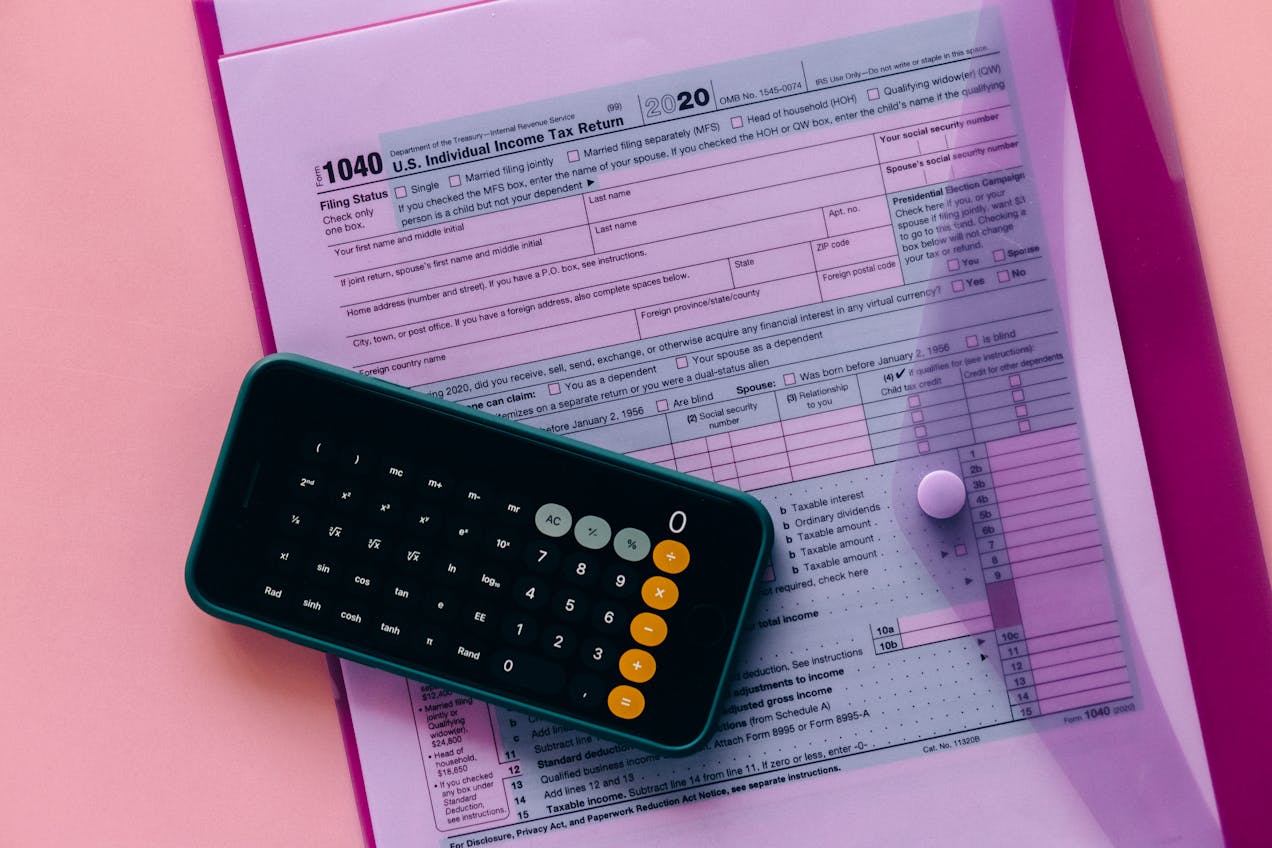

Save Money or Ensure Accuracy? Weighing the Pros and Cons of Tax Software vs. Professional Help Stuck between using tax preparation software or hiring a professional for your tax...

Introduction Tax season can be daunting, especially for US residents living abroad. With the right preparation, you can simplify the process and ensure compliance with IRS regulations. This guide...

Are you prepared for the tax season ahead? The new tax laws could significantly alter your 2024 tax return. Keep reading to find out how these changes will affect...

Are you a small business owner looking to maximize your savings this tax season? Discover the top tax deductions for 2024 that could significantly reduce your tax liability and...

Renouncing US citizenship Renouncing US citizenship is an irreversible action that carries profound personal, legal, and financial implications. While motivations can range from political disenchantment to financial liberation, the...

Introduction As U.S. citizens and long-term residents consider the significant decision to relinquish their nationality or residency status, understanding the financial implications becomes crucial. Among these is the U.S....

In today’s global economy, US shareholders of Controlled Foreign Corporations (CFCs) face a labyrinth of tax obligations that could rival the complexity of any ancient maze. The stakes? Compliance...